Hopefully by now you are in the final stages of preparation for Brexit, you should have your EORI number and be ready to trade internationally. The next stage for you to consider is what you are sending and how this needs to be identified on your paperwork for customs.

It is important that you have the following information for your goods at the time of booking:

– Value of the goods

– Description of what the goods are

– Commodity code associated with the goods

This will ensure the goods go through customs smoothly and prevent delays to your delivery.

Commodity Codes (HS Codes)

To continue shipping goods cross-border between the UK and EU after 31 December 2020, you will have to learn about commodity codes.

Please see below guide on how to find the right code for your invoice.

What are commodity codes (HS Codes)?

HS Code stands for Harmonised Systems Code and is a description and coding system developed by the World Customs Organization(WCO). It covers over 5,000 commodity groups, each identified by a six to twelve digit code. The first six digits of the HS are used universally. Each country may then add to the original six to suit its own tariff and statistical needs, creating eight, ten, and sometimes twelve digit national codes.

Where do I find them?

On the government website via this link: www.gov.uk/trade-tariff

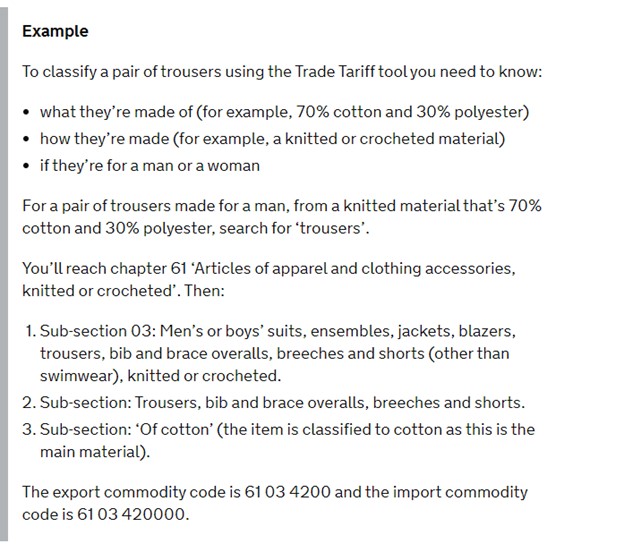

Things to consider when selecting a commodity code:Selecting the correct commodity codes for imports into or exports out of the UK or EU

– What the product is

– What it is made of

– What it is used for

– How the products work/function

The information required will be detailed so it is important that you follow the trail of your item through to the finer details, for example:

Don’t forget we are here to help so any questions please email brexit@absolutelycourier.com